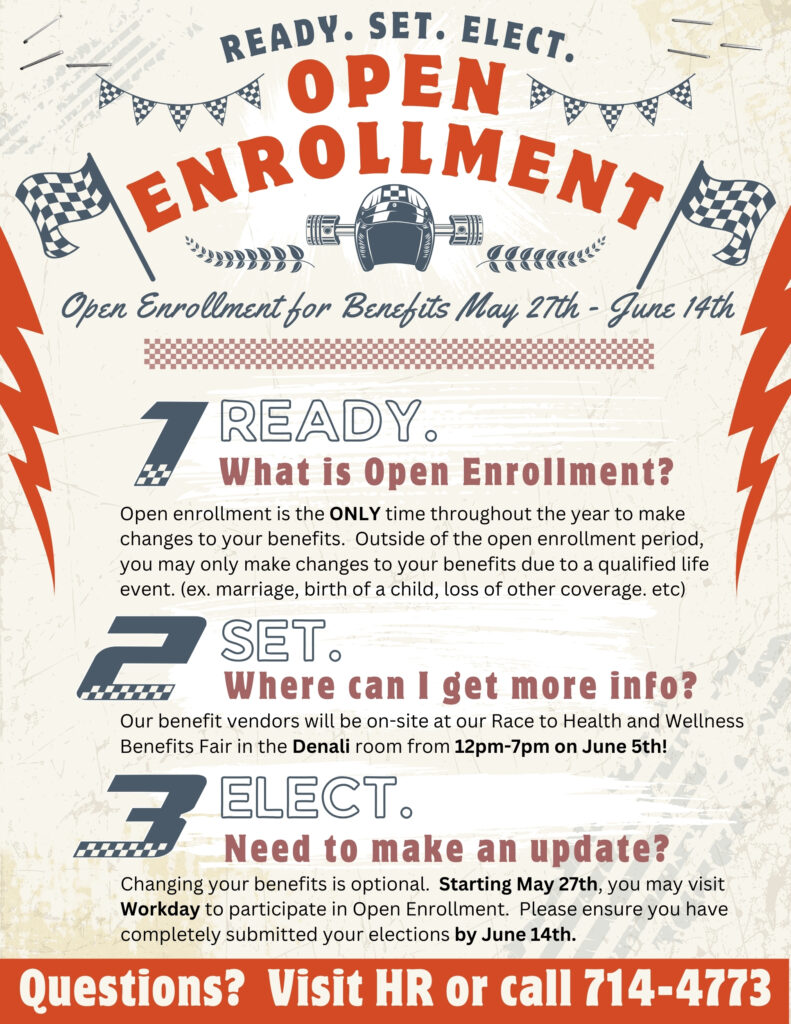

Open Enrollment is here!

Open Enrollment begins May 27th – June 14th.

Review your benefits in Workday!

myworkday.com

If you have any questions, please call HR at ext 4773.

Check out our Open Enrollment Guide

Health Plan

Please visit Workday if you are wanting to make changes to your health insurance elections. No action is required if you do not want to make changes.

Flexible Spending Account

You do not need to be enrolled in the medical plan to take advantage of the FSA!

(If you have an HSA, you cannot enroll in a Healthcare FSA)

With an FSA, you can set aside money from your paycheck before the government takes out taxes (usually 30% or more) to pay for healthcare and dependent child care expenses. You pay less in taxes. While you should only set aside enough money for those expenses you know you will incur during the plan year, the roll-over provision allows you to carry forward up to $640 into the next plan year for your healthcare FSA (there is no roll-over for a dependent care FSA).

Employees can set aside up to $3,200 in pre-tax money for eligible health care expenses and up to $5,000 for dependent care expenses.

Don’t forget – If you want to participate in a FSA you must re-enroll every year, so don’t miss your chance!

Short & Long Term Disability

CPH provides employees with employer paid Short-term Disability, optional additional employee paid Short-term Disability, and optional employer / employee paid Long-term Disability income benefits. In the event you become disabled from a non work-related injury or sickness, disability income benefits are provided as a source of income. You are not eligible to receive short-term disability benefits if you are receiving PTO, IAP or workers’ compensation benefits.

Life Insurance

Full-time and part-time employees are eligible to participate in the Life and AD&D insurance plan administered by New York Life. This benefit pays in the event of your death or the death of an eligible dependent. The plan also pays a benefit if you or an eligible dependent loses a limb, vision, speech, and hearing or dies due to an accident.

CPH pays the FULL COST to provide you with life and AD&D coverage equal to one times your annual pay if you are a full or part time employee.

During open enrollment you have the option of purchasing additional coverage for yourself or dependents.

Optional Life

Employee Life:

- Employees may elect coverage in $10,000 increments to a maximum of $700,000 or 7 times your annual salary, whichever is less.

- The amount of your benefit is reduced by 35% at age 65 and 50% at age 70.

- Spouse Life: You may choose to elect life coverage for your spouse in increments of $5,000. The Spouse Guarantee Issue $25,000.

- Child/Children Life: You may choose to elect life and AD&D coverage for your child or children amounts of $1,000, $5,000 or $10,000 per eligible child.

Optional Accidental Death & Dismemberment

This benefit pays in the event of your death, or covered member’s death, as a result of an accident or if you or an eligible dependent loses a limb, vision, speech, and hearing or dies due to an accident

Accidental Death & Dismemberment can be increased / decreased during open enrollment.

You can elect Coverage:

- for yourself in increments of $10,000 up to a maximum of, the lesser of 5 times your annual salary or $500,000

- for your spouse, in increments of $5,000, up to $500,000

- for your children, in increments of $1,000, up to $10,000

Retirement

As always, you can access your Voya Retirement account at www.voyaretirementplans.com and make contribution changes at any time during the year. CPH does offer employer matching and discretionary contributions, in order to receive them you must be full or part time, have completed 1 year of service in which you worked 1000 hours, and you must be 21 years of age. Eligible employees receive an automatic 2% discretionary contribution base on the employee’s annual salary. Additionally CPH will match the employee contributions up to a maximum of 3% of employee’s salary.

If you have never enrolled in Voya, you can do so by following the directions provided on the Enrollment Flyer. Once you have enrolled, you can make changes to your retirement plan contributions by logging onto their website. You can also manage your investments, take loans, and access the educational tools that Voya offers.

- www.voyaretirementplans.com

- Pierre Nicolet, VOYA Financial Advisor, 907.952.2174.

- Voya Call Center 1.800.584.6001

- CPH Human Resources – 714.4773